Department of Management Studies | Aalto University (external link)

The Department of Management Studies offers a dynamic environment for scholarship and learning.

Energy utilities form a substantial part of the business sector. The investments multinational energy firms make in certain energy sources therefore go a long way in dictating the pace of the energy transition. Investigating the organisational characteristics and regulatory environments related to foreign direct investment (FDI) in renewable energy sources allows us to understand the conditions under which firms invest in renewable energy sources beyond their borders and give us tools to scrutinize whether energy firms are truly working towards climate goals.

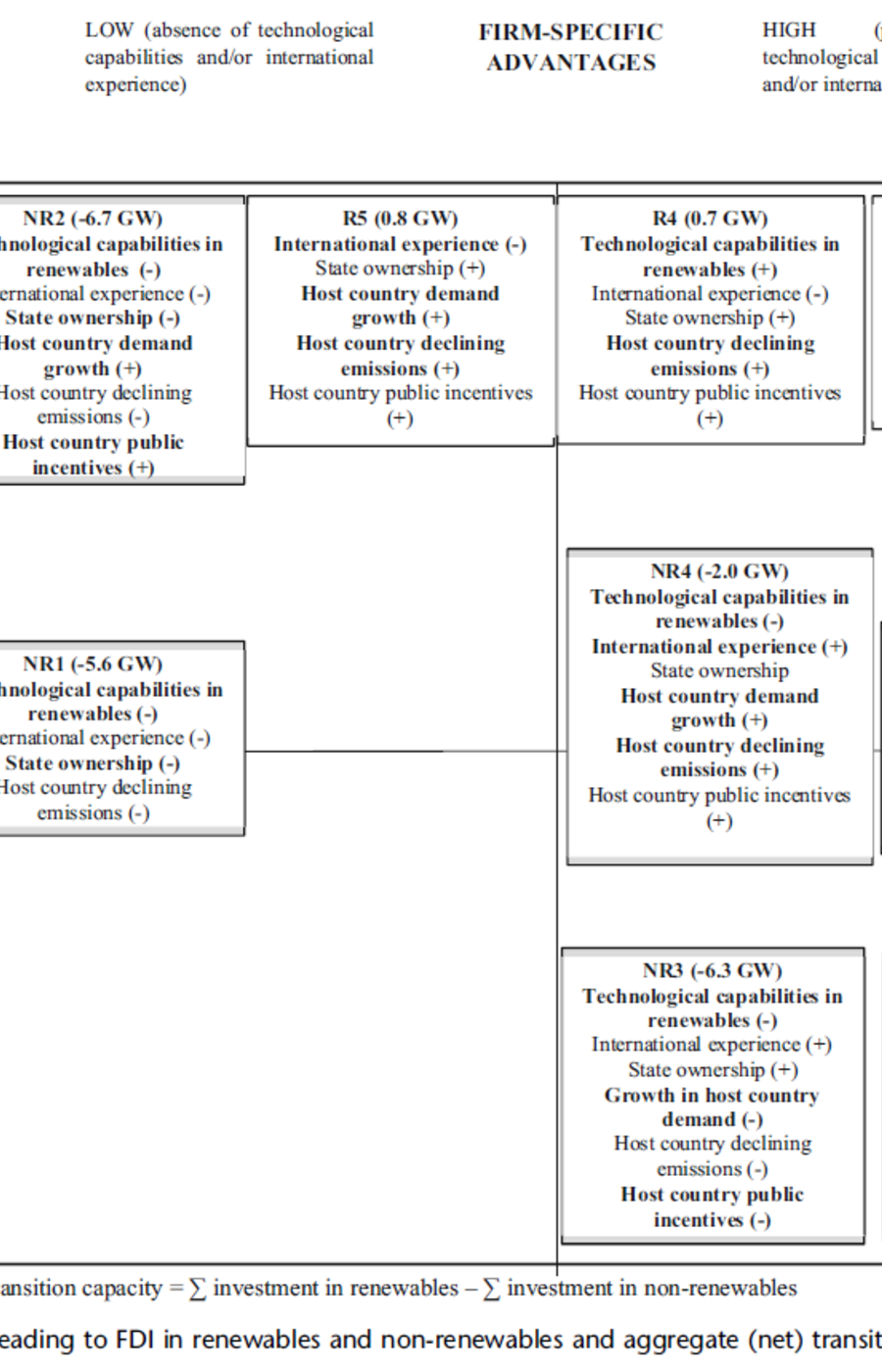

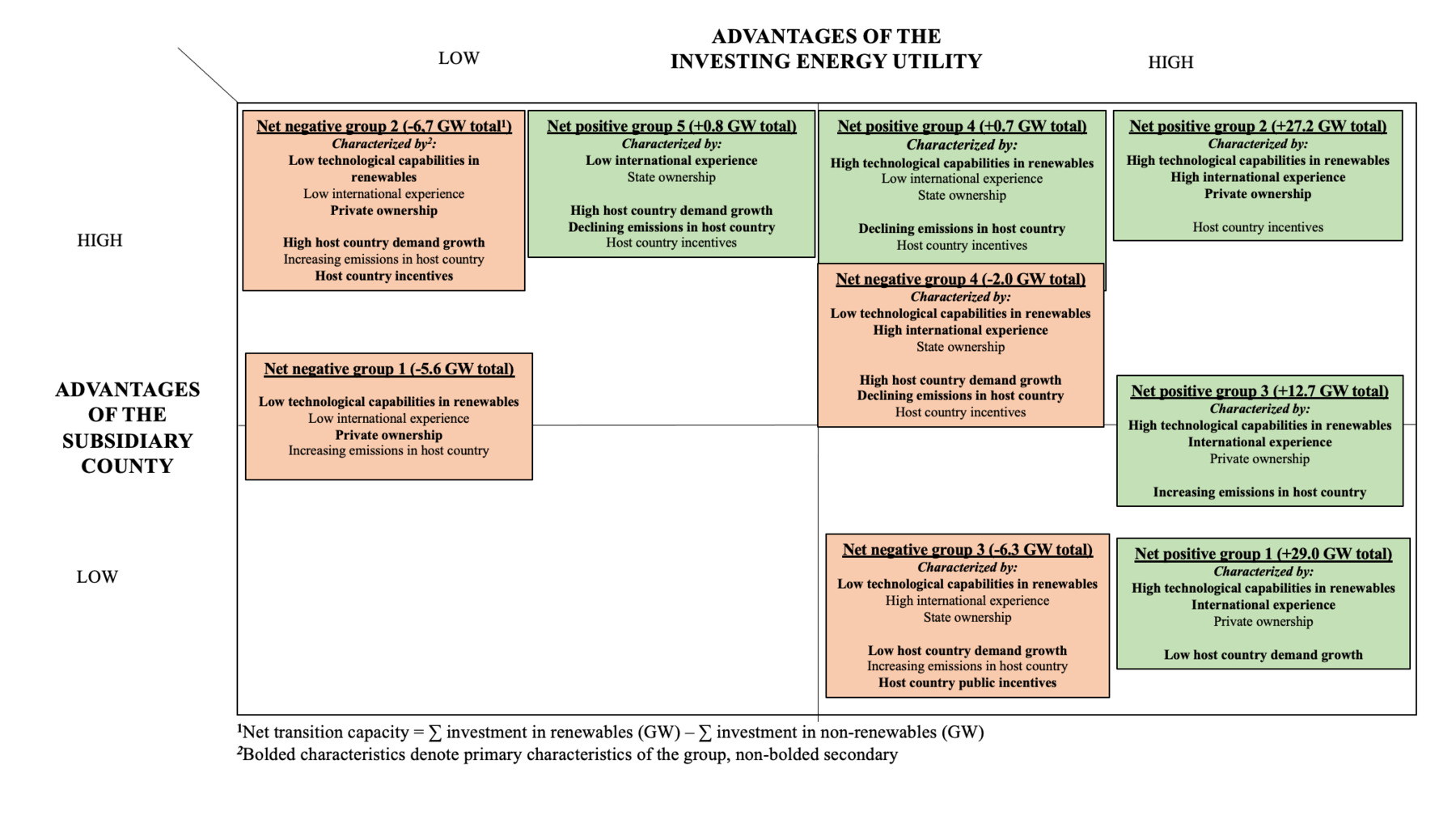

Researchers from Aalto University’s School of Business examined the conditions which influence the extent to which 17 multinational firms in the electricity sector engage in FDI in renewables, fossil fuels or both. The ownership structure of firms included in the study were state-owned, public-private partnership, and entirely private.

One could be forgiven for assuming that European state-owned utilities companies would be most progressive in terms of investing in renewable energy. EU governments are often at the forefront of low carbon policies and pledges, so it stands to reason their state-owned energy firms should pursue the same goals. However, the researchers identified that it is currently private companies in southern Europe (Italy, Spain, and Portugal) were most active in pursuing the transition to renewable energy initiatives.

This appears to be the case thanks to the geographical, regulatory, and business practice environments these firms operate in. Italy, Spain, and Portugal have relatively good geographical conditions for establishing renewable energy such as solar and wind power. In turn, these firms have developed technical competencies in their domestic markets, which enhances their ability to invest elsewhere. Their international experience allowed them to leverage their competencies globally. Private firms in general may be more willing to invest in different continents, whereas a state-owned firm may wish to ‘play it safe’ and only invest in proximate countries.

This research serves to underscore the fact that a successful energy transition cannot be achieved by technology alone. Investments in renewable energy infrastructures are determined by (inter)national business practices, policy regulation, societal and political will. Understanding the extent to which particularly state-owned firms invest in renewable energy technologies enables societies to hold their state energy firms accountable.

Researchers: Samuli Patala, Jouni Juntunen, Sarianna Lundan and Tiina Ritvala, Department of Management Studies, School of Business, Aalto University

Text: Peter Taggart

The Department of Management Studies offers a dynamic environment for scholarship and learning.